How can you qualify for a Conventional ninety seven financial loan? To qualify for a standard 97, at least a person borrower to the house loan has to be a primary-time homebuyer. This is often outlined as somebody who hasn’t owned a assets over the earlier a few several years.

Borrowers need a credit rating score of at the least 620 to receive any Fannie Mae-backed personal loan. The exception would be those with non-traditional credit who've no credit rating.

The capture is definitely the FHA’s home finance loan insurance plan. Contrary to PMI on a standard mortgage loan, FHA mortgage loan insurance policies premiums (MIP) received’t go away unless you place 10% or even more down. You’ll maintain paying the yearly rates right up until you pay off the loan or refinance.

You can begin your lender lookup and start your application or do your own personal research on lenders before making use of. Whatever your preference, it’s value examining your eligibility for this potent program.

The Conventional 97 home finance loan plan is available promptly from lenders across the nation. Talk with your lenders about the loan needs now.

This happens when you pay back down your home loan and as your property boost in worth. And with home values mounting quickly over the last few years, several homeowners can take out PMI quicker as opposed to later on.

Dan Eco-friendly (NMLS 227607) is really a accredited mortgage loan Specialist that has aided countless individuals achieve their American Desire of homeownership. Dan has produced dozens of tools, prepared Countless home loan articles, and recorded countless educational movies.

Comparable to the standard ninety seven, equally applications only permit the purchase of the Main home. And completion of the homeownership education and learning study course is sometimes necessary. These loans also allow using deposit help and gift resources for home loan-connected costs.

Personal loan dimensions may well not exceed community conforming property finance loan bank loan boundaries, customers have to offer proof of revenue and proof of deposit, and loans will not be fascination-only.

Indeed, personal home finance website loan insurance policy would make The three% down option dearer with a monthly foundation, in the beginning.

Most personal property finance loan lenders — whether they’re on the internet, downtown, or with your community — present Fannie Mae regular loans which include things like Traditional 97 loans.

If you’re in the market for a house but don’t have a great deal of cash for the deposit, a Conventional 97 property financial loan is an alternative really worth considering.

The standard 97 mortgage is frequently in comparison to the FHA property finance loan application. Both equally mortgage types are geared toward initial-time household prospective buyers and will give lower down payments. But each one has distinctive positive aspects. Benefits of an FHA mortgage

Though the borrower’s deposit prerequisite is considerably reduced, making it possible for them to buy a home Substantially faster — prior to home costs raise once more.

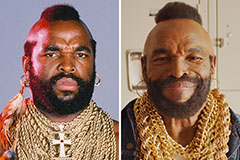

Mr. T Then & Now!

Mr. T Then & Now! Amanda Bynes Then & Now!

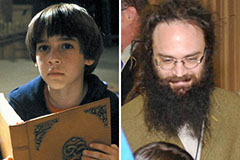

Amanda Bynes Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!